Most individual investors in India struggle not with the idea of investing, but with selecting the right mutual funds for their specific goals. This challenge becomes more pronounced for new parents, who are expected to few short-term and some long-term financial decisions while navigating limited time, incomplete knowledge, and conflicting advice.

The mutual fund ecosystem presents over 2,000 active schemes, each accompanied by performance numbers, ratings, rankings, and recommendations. In practice, fund selection often happens based on:

- Recent returns

- Brand familiarity

- External recommendations

- Short-term performance comparisons

These approaches fail to account for the most important variable in investing: the investment horizon.

A fund suitable for a one-year goal and a fund suitable for a fifteen-year goal must be evaluated very differently. Ignoring this distinction leads to inappropriate risk exposure, poor investor experience, and avoidable regret.

Toddl’s fund selection framework is designed to address this specific mismatch.

The Underlying Solution: Horizon-Based Fund Selection

The central premise of Toddl’s framework is straightforward:

Mutual funds must be selected based on the time for which capital is committed, not on the sheer popularity or recent performance.

Time horizon determines:

- The acceptable level of volatility

- The probability of recovery from drawdowns

- The relevance of short-term performance

- The role each asset class should play

Accordingly, Toddl classifies investment needs into four distinct horizons:

- Ultra – Short Term – Up to 1 year

- Short Term – 1–3 years

- Medium Term – 3–7 years

- Long Term – Beyond 7 years

Each horizon represents a different investment problem and therefore requires a different fund selection logic.

Removing Human Bias Through a Systematic Framework

Human decision-making introduces predictable biases into investing:

- Recency bias leads to chasing recent outperformers

- Loss aversion leads to premature exits

- Overconfidence leads to concentrated bets

- Authority bias leads to following well-known names without scrutiny

Toddl’s framework is designed to reduce these biases by:

- Defining fund eligibility before fund selection

- Separating basket objectives from individual opinions

- Applying consistent filters across market cycles

- Excluding discretionary overrides once rules are set

The framework governs inclusion, exclusion, and ongoing review. Individual preferences—whether internal or external—do not override these rules.

The Toddl Fund Selection Framework

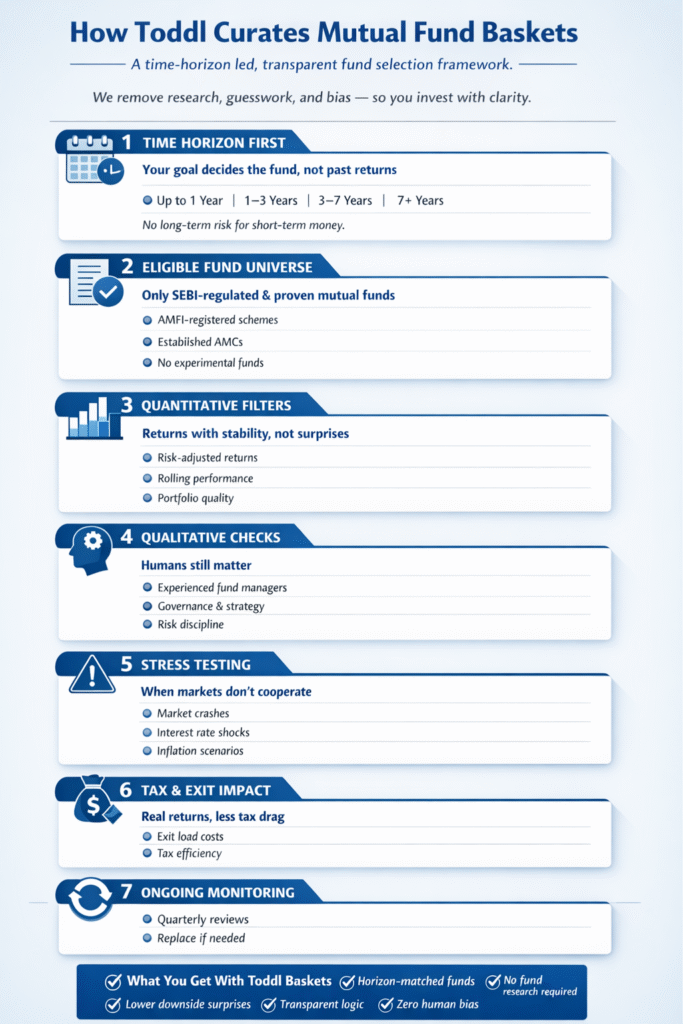

The framework operates through a sequence of clearly defined steps.

4.1 Investment Horizon Classification

Every fund selection exercise begins by assigning capital to a time horizon bucket. This classification is non-negotiable.

| Investment Horizon | Guiding Principle |

|---|---|

| Up to 1 year | Capital protection and liquidity |

| 1–3 years | Stability with moderate growth |

| 3–7 years | Equity-led growth with risk control |

| 7+ years | Maximum long-term compounding |

Funds that cannot reliably serve the stated objective of the horizon are excluded, regardless of historical returns.

4.2 Defining the Role of the Basket

Before selecting funds, Toddl defines the role of each basket.

Examples:

- Ultra-short-term baskets are not expected to maximise returns

- Long-term baskets are not designed to minimise volatility

- Medium-term baskets prioritise probability over perfection

This role definition determines acceptable fund behaviour and risk characteristics.

4.3 Fund Eligibility Filters

Only funds that pass baseline eligibility criteria are considered:

- Sufficient operating history relevant to the horizon

- Clear and consistent investment mandate

- Portfolio quality aligned with stated risk

- Behaviour across multiple market cycles

- Liquidity and structure suitable for retail investors

Funds failing these criteria are excluded before portfolio construction begins.

Application of the Framework Across Toddl Baskets

5.1 Ultra-Short Term Basket (Up to 1 Year)

Guiding principle: Capital protection takes precedence over returns.

This basket prioritises:

- Minimal NAV volatility

- High credit quality

- Short maturity profiles

- Daily liquidity

Funds that introduce duration risk, credit risk, or NAV instability are excluded even if they offer higher yields. Performance optimisation is secondary.

5.2 Short-Term Basket (1–3 Years)

Guiding principle: Balance stability with incremental return enhancement.

This horizon allows limited flexibility but does not permit aggressive equity exposure. Funds are selected to:

- Outperform idle savings and traditional fixed deposits

- Maintain manageable drawdowns

- Support exits without significant capital erosion

Funds suited only for long-term compounding are intentionally excluded.

5.3 Medium-Term Basket (3–7 Years)

Guiding principle: Equity must drive returns, structure must manage risk.

At this horizon:

- Equity exposure becomes essential

- Excessive capital protection becomes counterproductive

- Diversification replaces capital preservation as the risk manager

Funds are selected to provide equity-led growth while maintaining portfolio structure that improves the probability of staying invested across cycles.

5.4 Long-Term Basket (7+ Years)

Guiding principle: Maximise compounding, accept volatility.

For long-term goals such as child education and wealth creation:

- Equity dominates allocation

- Short-term volatility is accepted

- Debt is excluded to avoid return dilution

- Style diversification replaces asset dilution

A limited allocation to gold and silver is included strictly as a diversifier, not as a return driver.

Funds are chosen based on survivability, compounding ability, and consistency across multiple market cycles.

Why Some Popular Funds Are Excluded

Popularity, ratings, and short-term performance do not guarantee suitability.

Funds are excluded when:

- Their risk profile conflicts with the basket’s objective

- Their behaviour introduces volatility where stability is required

- Their structure dilutes long-term returns where growth is the objective

- Their history is insufficient relative to the horizon

Exclusion is a deliberate outcome of adhering to the framework, not an assessment of fund quality in isolation.

Capital Protection and Return Optimisation are Treated Differently by Design

Capital protection and return maximisation cannot be pursued simultaneously across all horizons.

Toddl’s framework explicitly separates these objectives:

- Short horizons prioritise protection and predictability

- Long horizons prioritise growth and compounding

- Medium horizons balance both with defined trade-offs

This separation prevents mismatched expectations and improves investment outcomes over time.

Framework Over Preference

Toddl operates on the principle that systems outperform discretionary decision-making over time.

Once defined:

- The framework guides fund selection

- Individual opinions do not override rules

- Changes are made only through structured review, not market noise

The framework evolves gradually as data, market structure, and investor behaviour change—never reactively.

Conclusion

Toddl’s fund selection framework exists to remove guesswork from investing and align fund choices with the most critical variable: time.

By prioritising structure over sentiment, and systems over shortcuts, Toddl constructs baskets designed to improve the probability of appropriate risk-taking and long-term success—especially for parents investing for their children’s future.

Disclaimer: Mutual fund investments are subject to market risks. Past performance does not guarantee future results. Please read scheme-related documents carefully before investing.