Build Your Child’s Future, with Investments in their Name

While retaining complete control over the investments

Download Toddl App and Invest for every Dream that matters

A SEBI-regulated, AMFI-registered platform (ARN-337868)

Platform for Parents across Bharat

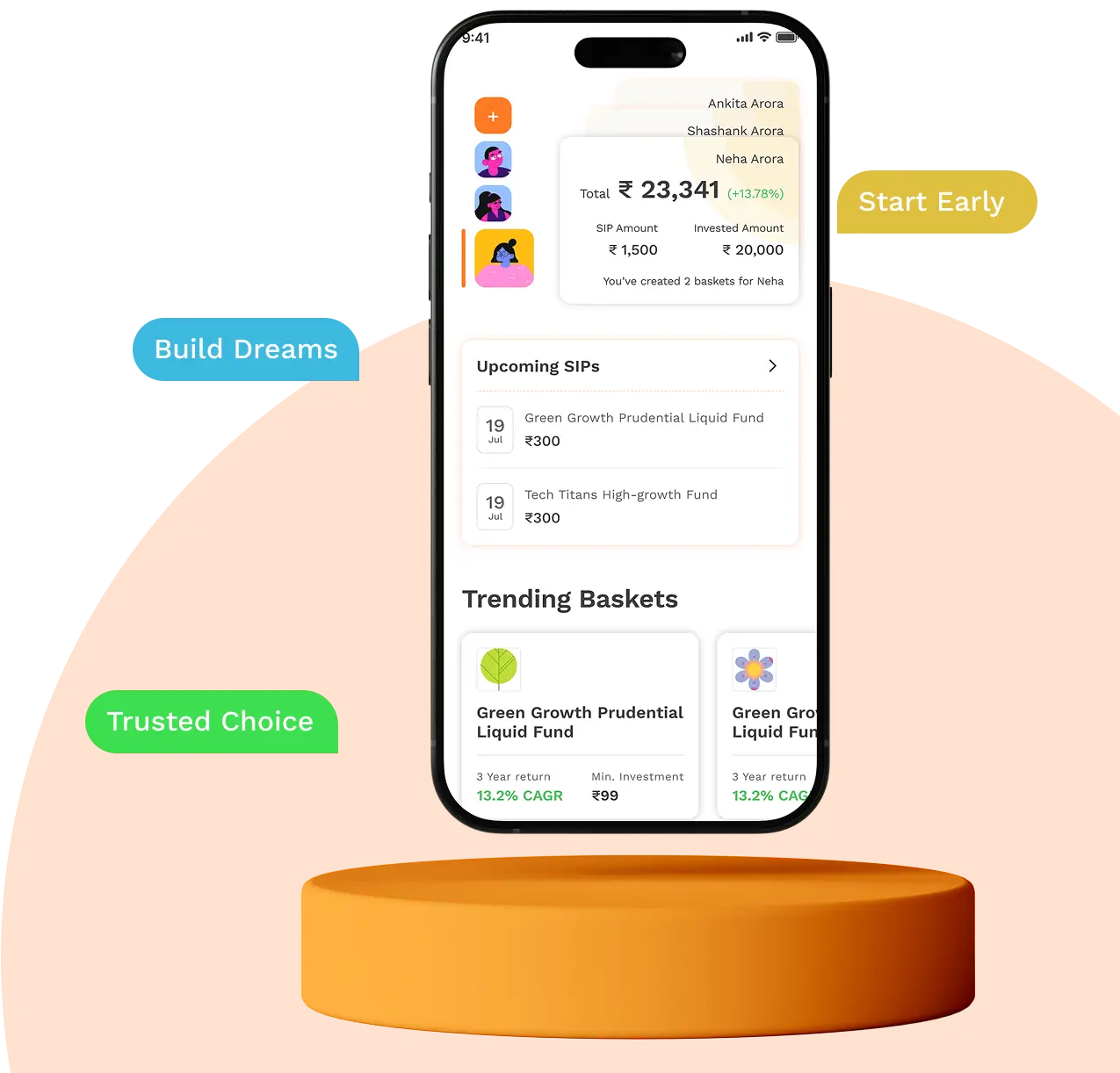

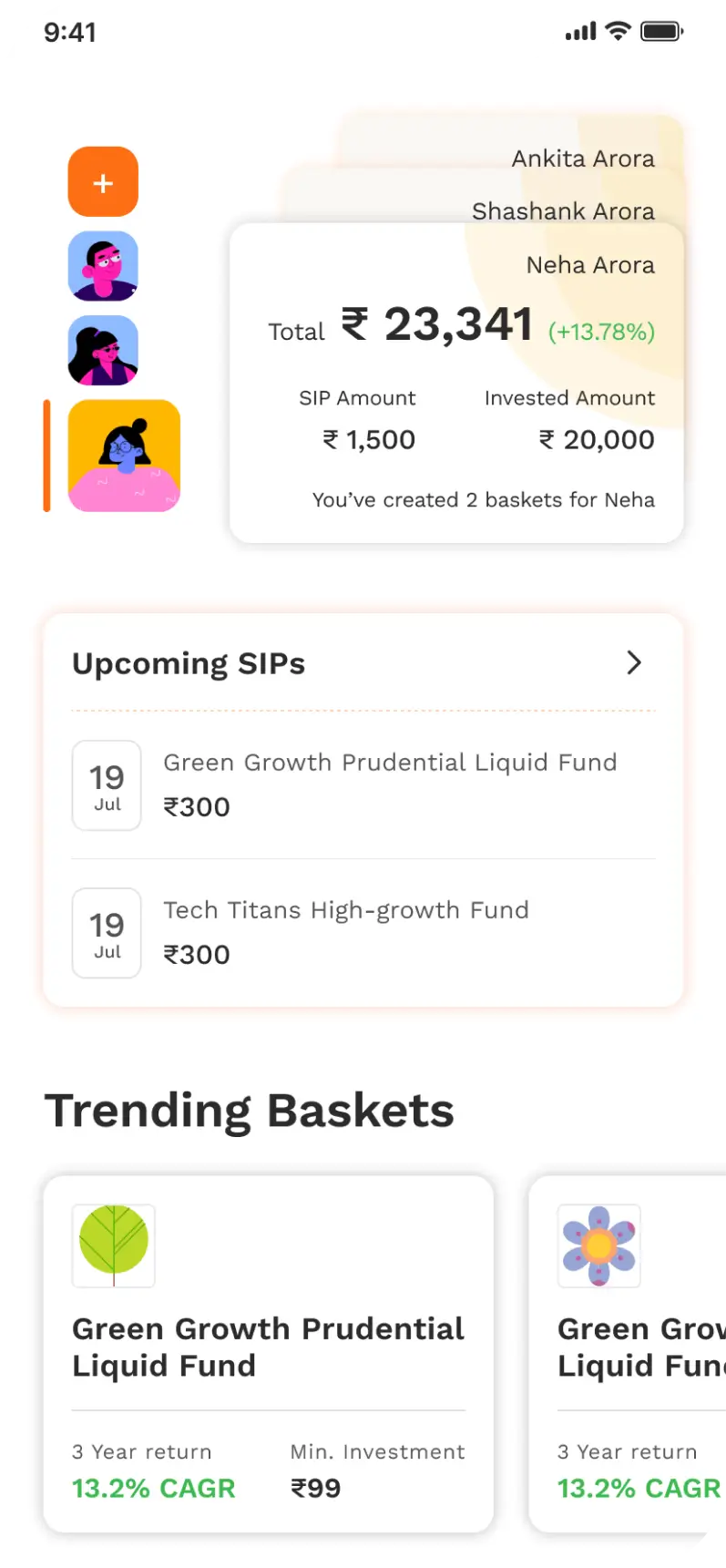

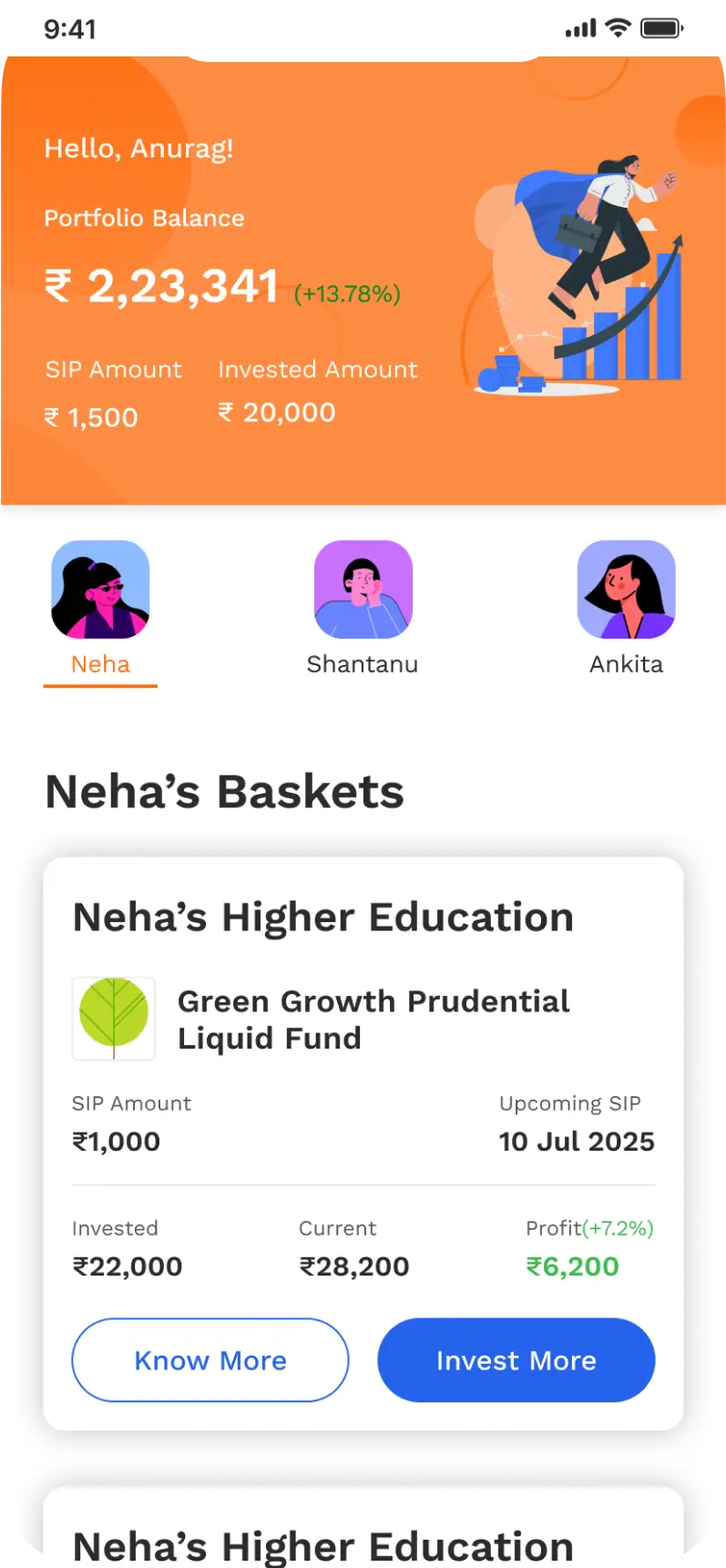

Child-First Experience

Watch child-wise reports to track the growth of every investment

Curated Baskets

Three ready-made baskets — Short, Medium, and Long-term — Easy to Invest, No Overthinking

UPI enabled Payments

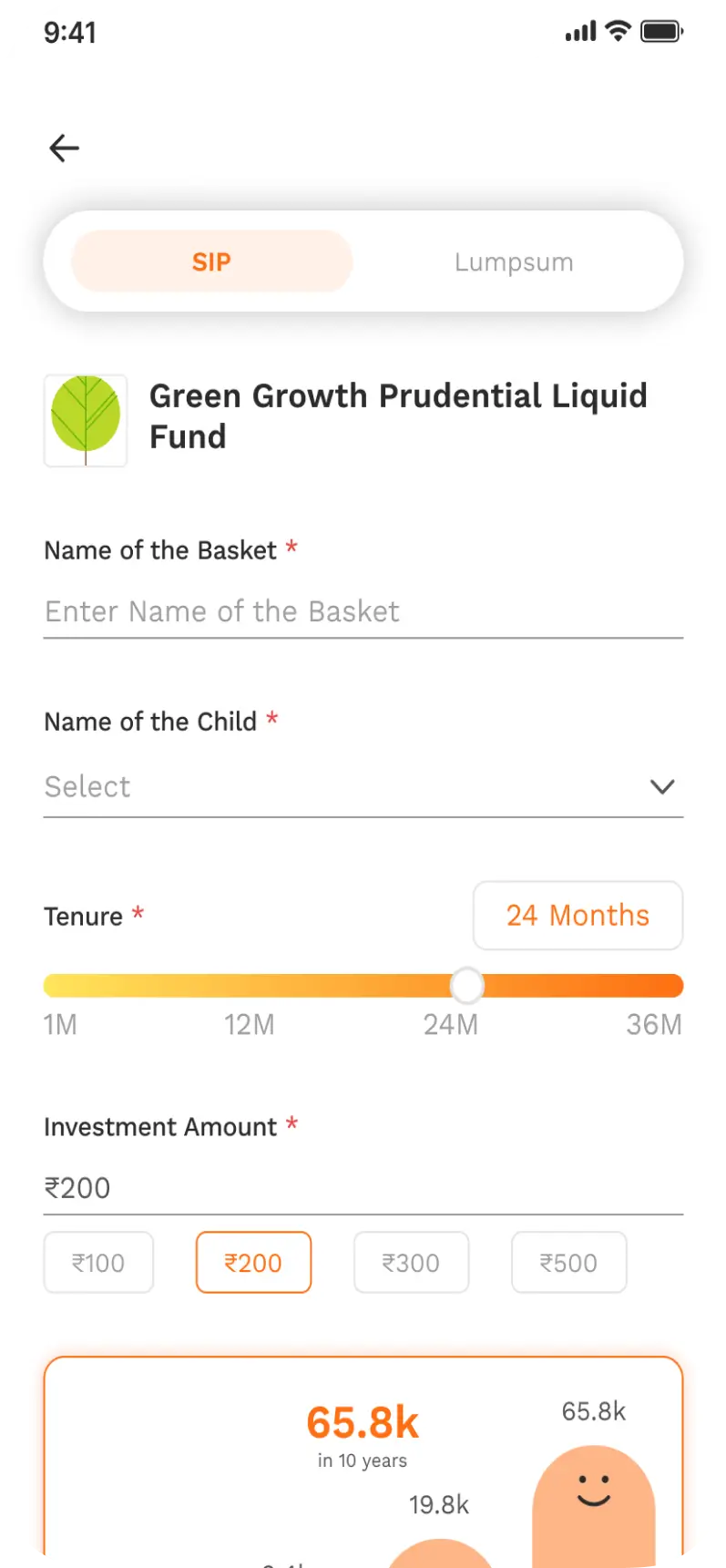

Invest in SIPs and lump sums with UPI — safe, quick and hassle-free

For Everyone

Start with just ₹100 — invest daily or monthly - Cancel SIPs anytime.

About Toddl

At Toddl we are building India’s first child-first financial ecosystem — helping parents plan effortlessly while inspiring children to explore money beyond just numbers. Our vision is clear: to become an end-to-end platform that supports every financial need of a child throughout their upbringing, from early investments to lifelong security.

App Highlights

Start investing in 3 steps

FAQs

What is Toddl?

Toddl is a savings and investment app that helps you grow your money with simple, automated plans — even if you're just getting started. Think of it as your smart money companion.

How do I start investing with Toddl?

Getting started is simple! Download the app, create your account, set your investment goals, and start with as little as ₹99. Our guided setup process makes it easy for beginners.

Is my money safe with Toddl?

Absolutely! Toddl partners with SEBI-registered investment companies and uses bank-level security protocols. Your investments are protected by regulatory oversight and advanced encryption.

What happens if I miss a payment?

No worries! You can pause, skip, or modify your investment schedule anytime. There are no penalties for missed payments, and you can resume whenever you're ready.

Is there any lock-in period?

No lock-in periods! Your investments are liquid and you can withdraw your money whenever you need it. However, staying invested longer typically yields better returns.

What if I need help?

We're here to help! Our customer support team is available 24/7 through the app, and we offer comprehensive guides and tutorials to make your investment journey smooth.